Additional Tax Resources

Tax How-Tos, Handouts, & Resources

Filing your taxes has many benefits, such as reclaiming refunds, staying out of trouble with the IRS, and checking up with the government to help prevent identity theft. The handouts below may be useful to work through various tax situations.

Handouts, InfoSheets, More Information

Filing Taxes

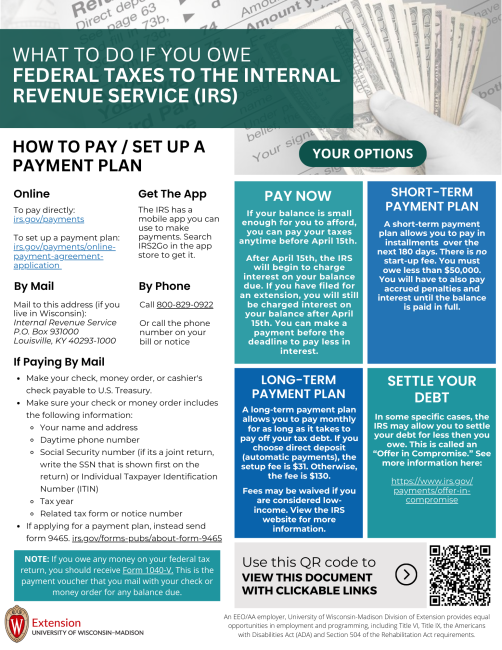

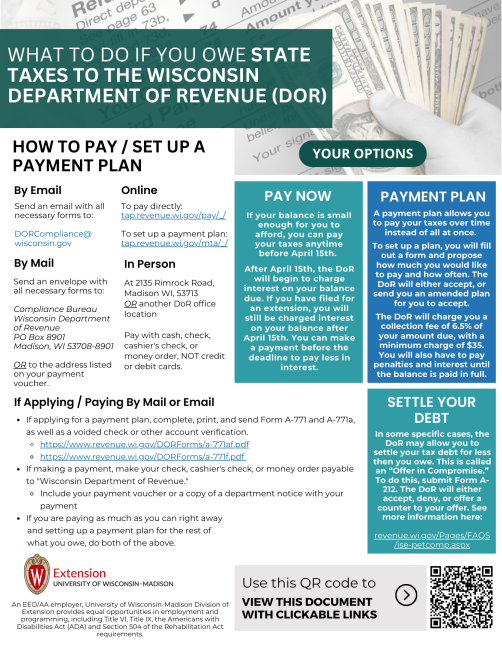

Paying Taxes

Other Tax Topics

Folletos, Hojas Informativas, Más Información

Cómo presentar impuestos

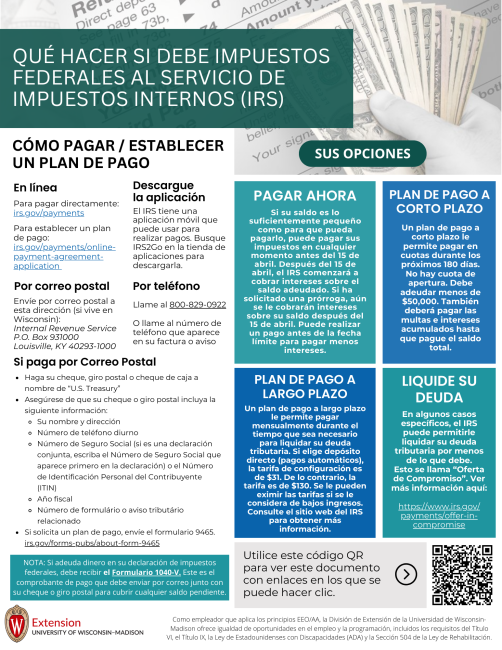

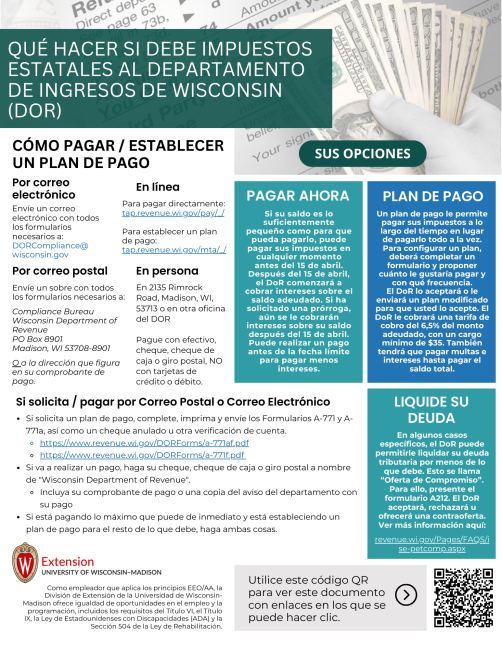

Pago de impuestos

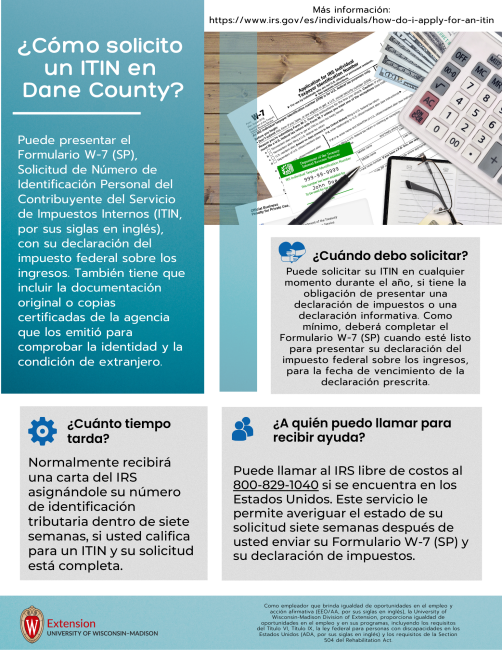

Otros temas dobre impuestos

Free Tax Assistance Outside of Dane County

*Please note that the links to tax preparation information are to external websites that may not yet be updated; read those sites carefully to be sure the information is current.*

Free tax assistance can be found across the state in some community centers, libraries, churches, shopping malls, and retirement homes. Most VITA sites are open from February 1 through April 15. To find the VITA or TCE site closest to you, please call:

- 1-800-829-1040 for VITA site locations,

- 1-888-227-7669 for TCE site locations, or

- call “211” for local free tax sites.

You can find a listing of free tax assistance sites on the Department of Revenue website.

This IRS link helps you find free tax sites based on the ZIP code you submit. This is not a comprehensive list, but includes some of the free tax sites available in the state.

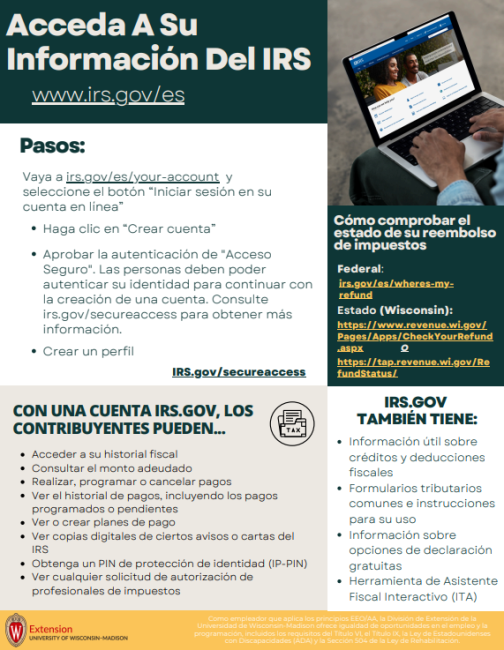

Tax Resources

Local Offices to Answer Your Tax Questions

Find Your Local IRS Office in Wisconsin

Find Your Local Social Security Office

Help with Federal Tax Returns

Help with State Tax Returns

Wisconsin Department of Revenue

Social Security Administration

Have you been contacted by the IRS?

Tax Credits

Tax credits reduce the amount of income tax you owe to the federal and state governments. Credits are generally designed to encourage or reward certain types of behavior that are considered beneficial to the economy, the environment, or to further any other purpose the government deems important. In most cases, credits cover expenses you pay during the year and have requirements you must satisfy before you can claim them.

Three tax credits that are specifically geared toward working adults who are earning low to moderate salaries are the Earned Income Tax Credit, Wisconsin Homestead Credit, and the Child Tax Credit. Please learn more about these credits to see if you are eligible for the money you deserve!

Earned Income Tax Credit

EITC, Earned Income Tax Credit, is a benefit for working people who have low to moderate income. A tax credit means more money in your pocket. It reduces the amount of tax you owe and may also give you a refund. Earned Income Credit means extra cash for working families! You may qualify for credits from the U.S. Government and the State of Wisconsin that could bring you more than $8,000!

Wisconsin Homestead Credit

The Homestead Credit is a tax benefit for renters and homeowners with low or moderate incomes. It is designed to lessen the impact of rent and property taxes. Qualifying persons can get back some or all of their state taxes withheld during the year. Those who do not have earnings, or whose earnings were too small to have taxes withheld, can get extra cash back from the State.

Child Tax Credit

The Child Tax Credit helps working families offset the cost of raising children. It is worth up to $1,000 per eligible child (under age 17 at the end of the tax year). If the Child Tax Credit exceeds taxes owed, families may receive some or all of the credit as a refund, known as the additional child tax credit (ACTC) or refundable CTC.