The Richard Dilley Tax Center – Copy (05/20/2025)

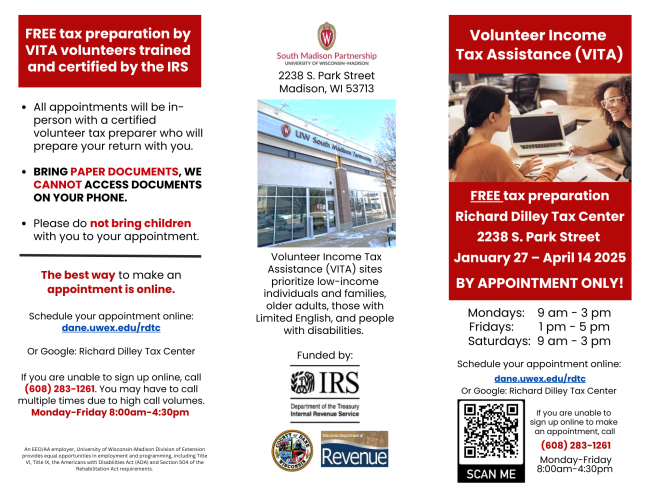

Richard Dilley Tax Center (VITA) – 2238 S. Park St., Madison, WI

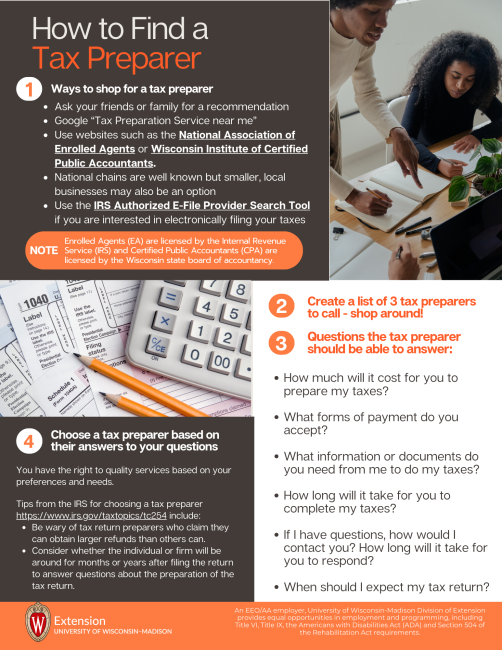

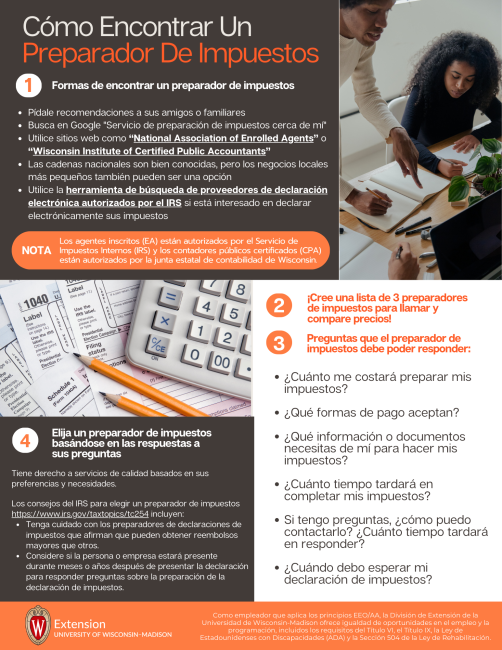

We have closed for the 2024 tax season. Explore free online filing options that include IRS Direct File and the IRS Trusted Partners Tool available at irs.gov. Paid tax preparation services are always an option, learn more here.

Hemos cerrado la temporada de impuestos de 2024. Explore las opciones gratuitas de presentación en línea, como el Direct File del IRS (disponible en Español) y la Herramienta de Socios de Confianza del IRS, disponible en irs.gov.

If you have an issue with a return done at 2238 S. Park St., please call 608-283-1261. The voicemail will be checked periodically.

The Richard Dilley Tax Center is a Volunteer Income Tax Assistance (VITA) site that prioritizes low-income individuals and families, older adults, those with Limited English, and people with disabilities.

Handouts, InfoSheets, More Information

Other Free Filing Sites

There are no in-person VITA sites that operate in the Dane County area year-round. There are, however, free virtual VITA options such as getyourrefund.org and myfreetaxes.com that offer the same services online to low-income taxpayers (below 66k and 60k income respectively). Below is a list of VITA sites that will open again in January 2025.

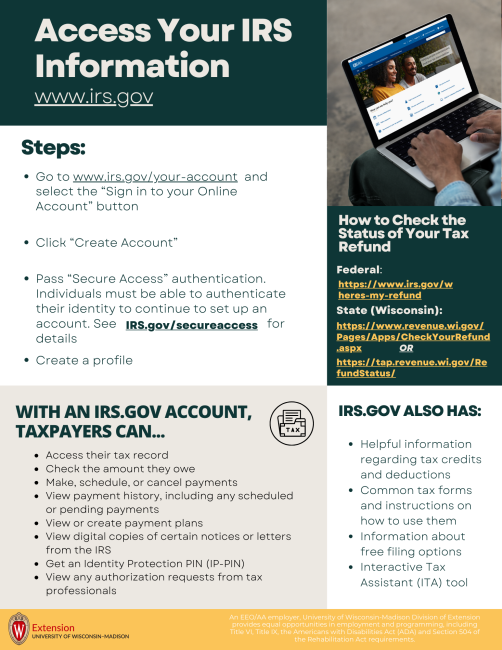

Check the Status of Your Refund Online

- Federal Internal Revenue Service (IRS) Refunds

- Wisconsin Department of Revenue “Where’s My Refund?“

Free Tax Education Resources

Filing your taxes has many benefits, such as reclaiming refunds, staying out of trouble with the IRS, and checking up with the government to help prevent identity theft.

See our additional tax resources here

Learn to save on your taxes using our free resources here

Or, check out this series of videos from the IRS.

IRS Direct File

IRS Direct File is a digital service that allows taxpayers to file their federal taxes directly with the IRS for free, avoiding all third-party organizations. Following a successful pilot in 2024, the IRS made Direct File a permanent tax filing option. This year, Direct File is available to eligible taxpayers in 24 states, including Wisconsin. Direct File guides taxpayers through answering questions to prepare their tax return step-by-step, with IRS customer service representatives available as needed. Use the Eligibility Checker at directfile.irs.gov to see if IRS Direct File is right for you.

Learn more about Direct File:

Free Online Options

Guided Tax Software Options

You can file both state and federal taxes online for free through the IRS and their trusted partners. Get started

Wisconsin Department of Revenue WisTax (for state taxes)

Virtual VITA Options

What is the difference between virtual VITA and guided tax software?

Some programs offer virtual VITA options for tax preparing. This means that they operate similarly to in-person volunteer tax preparation sites, where volunteers prepare and submit your taxes for you with your consent. However, this takes time and a lot of human effort.

Guided tax software uses a different model. On these websites, you are asked a series of automatic plain-English questions to determine what documents you need and what tax credits you are eligible for. These services are designed to ask you about every tax-relevant life situation you might be in so they don’t make mistakes. Unless there is an issue with your return, there is no human involvement needed. This makes the process fast and efficient.

Types of Returns We Do Not Do

If any of these situations apply to you, you will not be able to get your taxes done at our site. Please see “Free Self-Filing Options” below or consult with a paid tax preparation service. No appointments that include amendments or past years until March 1st.

- Married filing separately

- People divorced in 2024

- People who sold CRYPTO or BITCOIN or VIRTUAL CURRENCY

- Two or more businesses or businesses with one of the following: inventory, expenses over $5000, employees, depreciation, shows a loss

- International Students here on a VISA (J-1, F-1, etc.) (get info here)

- People who immigrated to the USA in 2024 – you must have lived in USA for all of 2024

- People with more than two W2G’s from gambling

What to Bring to Your Appointment – No Electronic Documents

- A PICTURE ID

- PRINTED / PAPER DOCUMENTS (not on phones/laptops)

- Social Security Cards OR ITIN forms OR SSA-1099 statement for you and all dependents, spouse, if filing jointly . . .NO EXCEPTIONS! Physical cards or official ITIN forms required.

- SSA-1099 is benefit statement for older adults getting social security, it must show name and full number from Social Security office

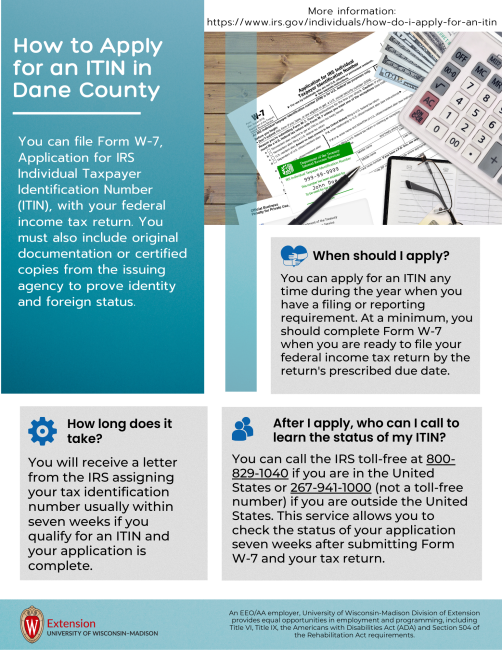

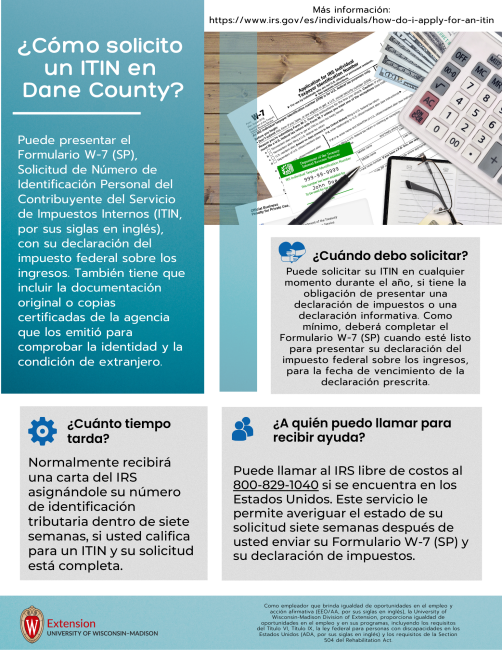

- ITIN stands for Individual Taxpayer Identification Number for those without a social security number, you must bring ITIN form from IRS

- Completed INTAKE FORM, IRS Form 13614-C, filled out to the best of your ability. You are not required complete the intake form in advance, but the process will be faster if you come with it filled out.

- Pick up form: 2238 S Park St Madison WI 53713, or 5201 Fen Oak Dr. Suite 138 Madison WI 53718, OR

- Print and bring it yourself using the links below: OR

- Complete the form when when you arrive

- Income Statements, such as:

- Wage statements—Form(s) W-2

- Pension and Social Security Statements- Form(s)1099R and SSA-1099

- 1099G: Unemployment

- All 2024 Financial Statements, such as:

- Interest and dividends statements—Form(s) 1099INT and 1099DIV

- Mortgage interest statements—Form(s) 1098

- Tuition payments statements—Form(s) 1098T

- Copy of tax returns from 2023, if available

- A record of any estimated tax payments made for the 2024 tax year

- Affordable Care Act (ACA) Health Insurance Marketplace statement—Form(s) 1095A – this is required if you had Marketplace Insurance at any time during 2024

- Information for all other deductions/credits

- Bank account information (account and routing number) for direct deposit of your refund

- Completed 2024 Rent Certificate, signed by the Landlord/Management Company OR Copy of 2024 Property Tax bill, if applying for Homestead. Access a copy of your property tax bill at Access Dane

- Please do not bring children to your appointment.

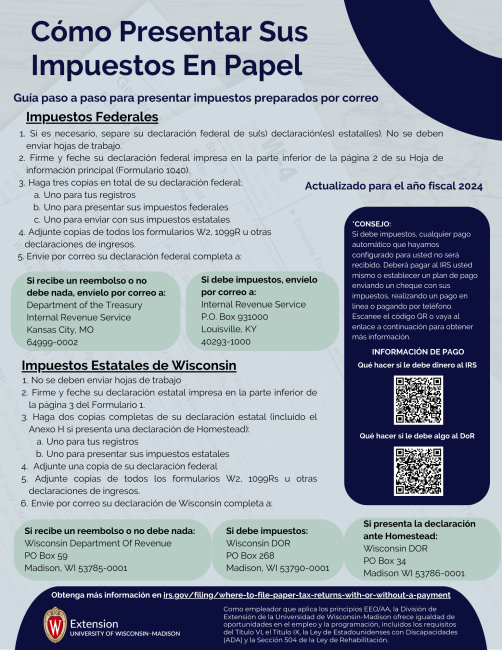

Have your taxes (including Homestead) prepared for FREE at the Richard Dilley Tax Center, a partnership with Dane County UW Extension, IRS, UW-SMP, and the Wisconsin Department of Revenue. This Volunteer Income Tax Assistance (VITA) Site prioritizes low-income individuals and families, older adults, those with Limited English, and people with disabilities.

ASL, language interpretation, or other reasonable accommodations are available upon request. These services are free. Please tell us your needs when scheduling appointments. Provide 10 days’ advance notice for ASL requests.

All appointments will be in-person with a certified, volunteer tax preparer who will prepare your return in your presence. Learn about volunteer opportunities here.